24+ Payoff amount calculator

Line of credit information. 399 824 APR 3.

Free 24 Sample Payment Schedules In Pdf Ms Word

The AARP mortgage calculator.

. While you would incur 3039 in interest charges during that time you could avoid much of this extra cost and pay off your debt faster by using a 0 APR balance transfer credit card. The amount you are currently paying per month on this line of credit. To show you how this works lets compare two 30-year fixed mortgages with the same variables.

The 1st payment is. The ira calculator exactly as you see it above is 100 free for you to use. If you would like to pay twice monthly enter 24 or if you would like to pay biweekly enter 26.

Loan amount - the amount borrowed or the value of the home after your down payment. Average Daily Balance The base amount used to calculate credit card interest charges. In order to pay off 10000 in credit card debt within 36 months you need to pay 362 per month assuming an APR of 18.

Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but. Ideally youd like to get rid of the debt as quickly as possible while building up the amount of money you have invested in the home. 18 for three months.

Amount of time until the loan is paid off. The mortgage payoff calculator helps you find out. Ad-Free Pro version is paid.

SoFis fixed rates start at 399 APR and variable rates start at 324 APR when you enroll in AutoPay. With this unique 4 column format you can compare scenarios side-by-side print amortization schedules and plan your payoff strategy. Try this free feature-rich loan calculator today.

We used the calculator on top the determine the results. Fast easy and all online. March 10 2016 at 159 pm.

Because we calculated the payment amount assuming 24 payments we need to edit row 2. 10 for two months. Enter the loan amount the loan term in years along with the stated interest rate eg.

The remaining term of the loan is 24 years and 4 months. 30-Year Fixed Rate Mortgage. The longer the term or amount of time you agree to lock.

The Mortgage Payoff Calculator above helps evaluate the different mortgage payoff options including making one-time or periodic extra payments biweekly repayments or paying off the mortgage in. Plug in your information to see which approach will have you debt-free in the. By paying extra 50000 per month the loan will be paid off in 14 years and 4 months.

The Early Loan Payoff Calculator is another loan payoff calculator that will help you figure out how much extra to pay each month to pay down the loan by a desired years or months. This automatic calculator figures actual monthly loan repayments from a financial institution offering the entered terms. If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase.

This amount is used to calculate how long it will take. Credit card payoff calculator. The rates shown above are calculated using a loan or line amount of 30000 with a FICO score of 700 and a combined loan-to-value ratio of 80 percent.

Annual Fee The amount you pay every year to your credit card company for maintaining your credit card. A loan is a contract between a borrower and a lender in which the borrower receives an amount of money principal that they are obligated to pay back in the future. Finance Charge Interest charged for borrowed money.

This judgment payoff calculator will help you see how many payments that interest and judgment might be spread over. Fixed payments paid periodically until loan maturity. Interest calculator for a 150k investment.

That savings can be figured out. Post-judgment interest accrues on the entire amount of the judgment including pre-judgment interest and court costs. Using our Credit Card Payoff Calculator youd need to pay 200 a.

Click the View Report button to see a complete amortization payment schedule and how much you can save on your mortgage. With our Student Loan Debt Payoff Calculator you can check how long it will take you to pay off your student loans based on your. The first one makes extra payments at the start of the term while the second one starts making extra payments by the sixth year.

Mortgage loan basics Basic concepts and legal regulation. Say you found out you owed 3000 on a Chase Sapphire Preferred Card with an interest rate of 2299 APR 1749 - 2449. You can get ahead on your payment schedule and lower the total amount of.

This mortgage payoff calculator helps you find out. Or 24 for two years. Ultimate Loan Payoff Calculator Borrow or pay any amount on any date at any rate.

Use our payoff calculator and see for yourself. The accelerated biweekly version will be higher at 59677. How much will my investment of 150000 dollars be worth in the future.

The accelerated amount is slightly higher than half of the monthly payment. Best home equity loan rates in September 2022. In this calculator the interest is compounded annually.

November 1 2015 at 824 pm. READ MORE Debt Payoff Planner review RELATED. To give you an idea see the table below.

Please enter the amount you actually pay not the minimum payment. SCHEDULE A FREE CONSULTATION Practice Areas. 30-Year Fixed Mortgage Principal Loan Amount.

The Accelerated Debt Payoff Calculator below takes your information and projects payoff timing for your current payment structure and amount a consolidation loan approach and an accelerated timing approach using additional funds towards your payment each month. Savings of nearly 56000 but you also have cut out the time that you will be repaying your loan down to just 24 years instead of the full 30 years. Line of Credit Payoff Calculator Canadian.

5 7 10 15 20 years 3. Common terms include three six nine 12 18 24 36 48 and 60 months. Ready to calculate the payoff amount on your student loans or wondering how to calculate student loan payoff.

Balance transfer calculator. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. 193 per month will payoff credit line in 24 months indicates required.

See The Ascents debt snowball calculator to see which. Most loans can be categorized into one of three categories. Also this calculator has the ability to add an extra amount extra payment to the monthly mortgage and turbo charge your interest savings.

Just a small amount saved every day week or month can add up to a large amount over time. Looking for a flexible free downloadable loan calculator built in Excel. For instance if your monthly payment is 119354 its biweekly counterpart is 55086.

Monthly Payment The amount of money applied to the balance on a monthly consistent basis.

10 Best Printable Hourly Calendar Template Calendar Template Weekly Planner Template Planner Template

2

What Is Financial Literacy Advance America

Christmas Gift Shopping List Word Doc 24 Christmas Wish List Template To Fill Out By Everyone Christmas Wish List Template Christmas Wishes List Template

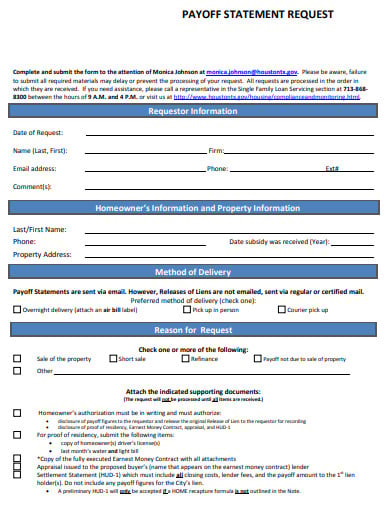

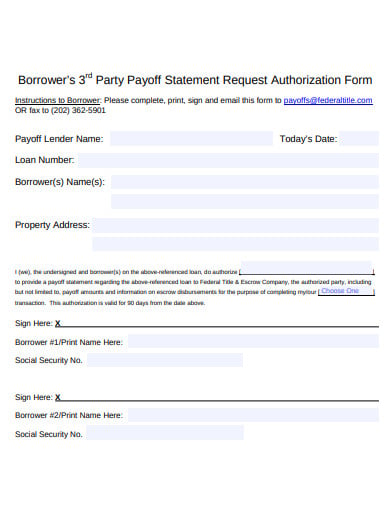

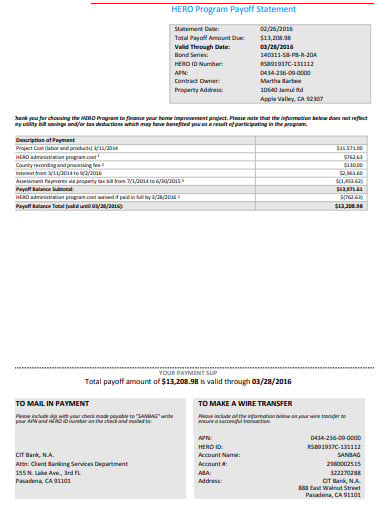

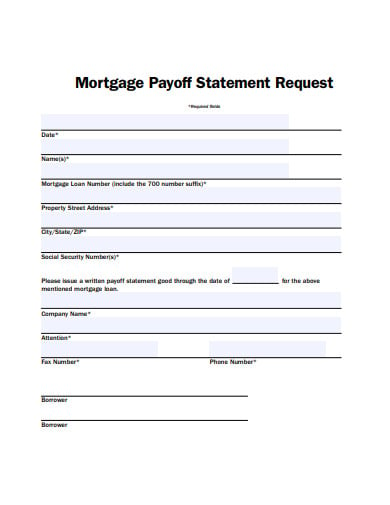

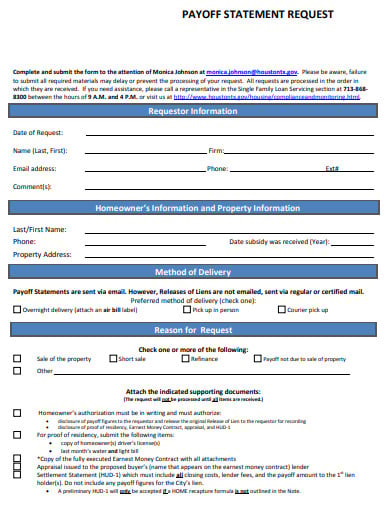

13 Payoff Statement Templates In Pdf Free Premium Templates

16 Useful Service Invoice Templates Excel Word Find Word Templates

2

10 Budget Management Templates Pdf Word Pages Free Premium Templates

Investordaypresentation

Investordaypresentation

13 Payoff Statement Templates In Pdf Free Premium Templates

Job Application Template Word Inspirational Job Application Template 24 Examples In Pdf Word Job Application Template Job Application Employment Application

13 Payoff Statement Templates In Pdf Free Premium Templates

Minimal Design Fillable Balance Sheet And Income Statement Etsy Balance Sheet Balance Sheet Template Excel Templates Business

13 Payoff Statement Templates In Pdf Free Premium Templates

Explore The Bilvam Regency Project In Surat Real Estates Design Real Estate Brochures Real Estate Marketing Design

How Much Does The Average Wedding Cost Nerdwallet Wedding Costs Average Wedding Costs Wedding Expenses